Updated 5/28/2020

Updated 4/27/2020

PANDEMIC UNEMPLOYMENT ASSISTANCE! NEW ONE-STOP MARYLAND UNEMPLOYMENT INSURANCE ONLINE APPLICATION

Starts Friday, April 24th! The Maryland Department of Labor has announced the launch of a new one-stop unemployment insurance application to allow all Marylanders to file all types of claims entirely online. With BEACON One-Stop, Marylanders can file claims for many unemployment benefit programs through a single application, including those who are eligible for the Pandemic Unemployment Assistance (PUA) program, the Pandemic Emergency Unemployment Compensation (PEUC) program, and individuals who were previously required to file by phone. The launch of this new online application has allowed Maryland’s Division of Unemployment Insurance to implement all three Coronavirus Aid, Relief, and Economic Security Act (CARES Act) programs. To learn how services have been improved and expanded, visit the BEACON One-Stop Overview page. Click HERE to directly access the new BEACON One-Stop.

- Visit MDunemployment.com and select “Apply for Unemployment Insurance Benefits” in the left hand column. This will take you to the BEACON one-stop application page.

- The first time that you visit the application, you will need to activate your account by providing your social security number and choosing a Username and password. If you have previously applied for UI benefits in Maryland, you will need to have your UI application PIN available to validate your identity.

- Once you have activated your account, you will be able to file your PUA claim.

- Social security number;

- Date of birth;

- Alien registration number, if you are not a citizen;

- Residential and mailing address;

- Telephone number and email address;

- Name, date of birth, and social security number of all dependents under 16 years of age that you will claim, as well the same information for each dependent’s other parent, such as the social security number and date of birth for any dependents that you claim;

- If you worked for the federal government, you will also need a SF-8 or SF-50 form; and

- If you are separated from military service, you will also need Form DD-214, member 4 copy.

- Documentation of the income that you earned in 2019 (Schedule K-1, Form 1099, or summary of quarterly payments);

- All necessary licenses and permits for your self-employment; and

- Proof of an offer to begin employment that was postponed or withdrawn due to COVID-19.

Updated 4/24/2020

Updated 4/24/2020

Maryland Roadmap To Recovery From COVID 19. This is the Governor’s announced plan for business reopening.

Click here to download the Governor’s plan to reopen the State’s businesses

Updated 4/23/2020

NEED HEALTH INSURANCE? COVID-19 SPECIAL ENROLLMENT NOW OPEN!

Do you need health insurance? Maryland Health Connections’ COVID-19 Special Enrollment Session is still open for uninsured residents to apply for health insurance, including Medicaid. Get covered by visiting https://www.

Updated 4/22/2020

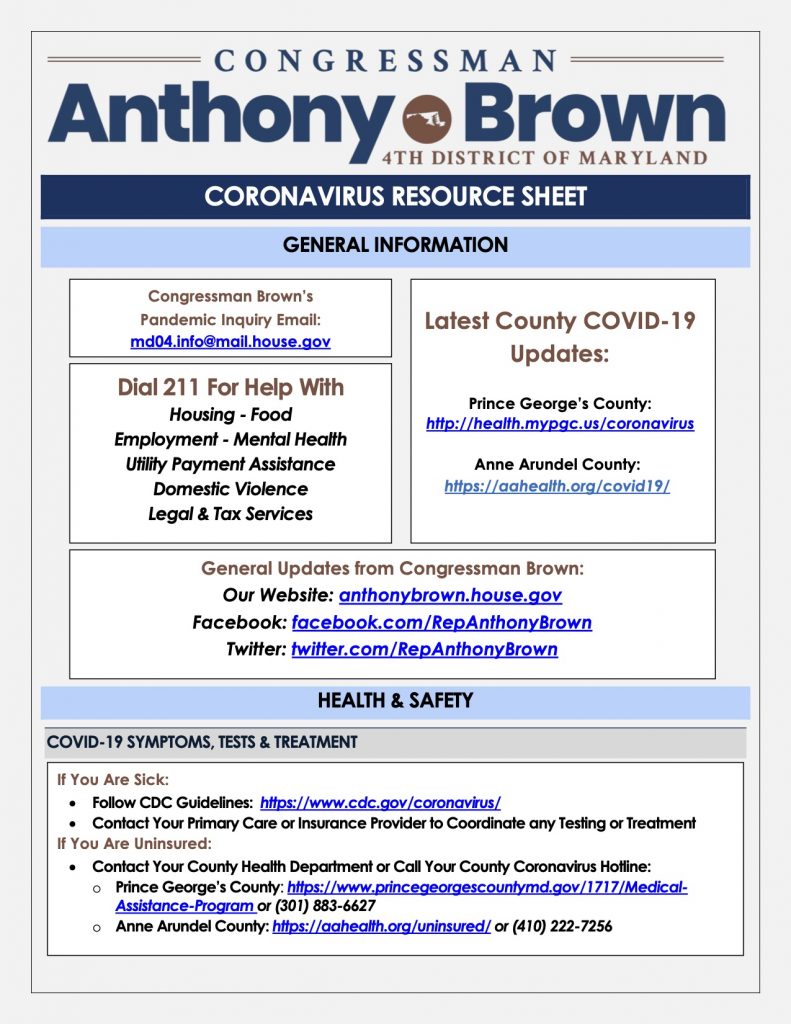

Click here to download the rest of Congress Anthony Brown’s Coronavirus resource sheets

Updated 4/18/2020

Updated 4/15/2020

The entire state of Maryland has received designation for SBA assistance. Small businesses can apply here.

https://commerce.maryland.gov/fund/maryland-small-business-covid-19-emergency-relief-fund-programs

Maryland COVID-19 Emergency Relief Fund Programs for Businesses

Maryland has authorized $130 million in loan and grant funding for small businesses and manufacturers that have been negatively impacted by the Coronavirus (COVID-19). This emergency assistance provides interim relief and proceeds that can be used to pay cash operating expenses including payroll, suppliers, rent, fixed debt payments and other mission critical cash operating costs.

If you are a Maryland-based business impacted by the Coronavirus with under 50 full- and part-time employees, or a Maryland manufacturer, check out the programs below to see if you qualify for assistance.

- Maryland Small Business COVID-19 Emergency Relief Loan Fund – This $75 million loan fund (for for-profit businesses only) offers no interest or principal payments due for the first 12 months, then converts to a 36-month term loan of principal and interest payments, with an interest rate at 2% per annum. Learn more.

- Maryland Small Business COVID-19 Emergency Relief Grant Fund – This $50 million grant program for businesses and non-profits offers grant amounts up to $10,000, not to exceed 3 months of demonstrated cash operating expenses for the first quarter of 2020. Learn more.

- Maryland COVID-19 Emergency Relief Manufacturing Fund – This $5 million incentive program helps Maryland manufacturers to produce personal protective equipment (PPE) that is urgently needed by hospitals and health-care workers across the country. More details are expected to be announced by Friday, March 27, 2020.

http://www.labor.maryland.gov/employment/covidlafund.shtml

COVID-19 Layoff Aversion Fund – Workforce Development and Adult Learning

Governor Larry Hogan and the Maryland Department of Labor have launched the new COVID-19 Layoff Aversion Fund, which is designed to support businesses undergoing economic stresses due to the pandemic by preventing or minimizing the duration of unemployment resulting from layoffs. The award (up to $50,000 per applicant), will be a quick deployable benefit and customizable to the specific needs of your business to minimize the need for layoffs.

Labor is accepting grant applications from small businesses for awards from now through 30 days after the State of Emergency ends (subject to funding availability).

How can it help me?

- ✔ Providing funds to cover the cost of purchasing remote access (ex. computers, printers, etc.) equipment to allow employees to work remotely from home versus being laid off;

- ✔ Providing funds to cover the cost of purchasing software or programs that an employee would need to use from home;

- ✔ Supporting businesses that take advantage of the Unemployment Insurance Work Sharing Program by supplementing the employee’s income and benefits;

- ✔ Providing funds to cover the costs of cleaning/sanitization services so that small businesses are able to keep employees at work on site, but only if a frequent deep cleaning to prevent exposure occurred;

✔ Paying for liability insurance for restaurants that convert to delivery while under emergency circumstances;

- ✔ Providing funds for training or professional development opportunities for employees to avoid layoffs; and

- ✔ Adopting other creative approaches and strategies to reduce or eliminate the need for layoffs in the small business community.

Examples of how a business may demonstrate the need for layoff aversion funds:

- I run a call center where employees usually work in an office setting. To support social distancing, I’d like my employees to work remotely, which will require equipment such as reliable headphones and laptops for each employee. If they do not have this equipment, I will need to layoff my staff.

- I could ask employees to use their personal phones and work remotely, but I do not have the funds to support the cell phone packages. If provided funds to reimburse employees for the increased data usage, my business could avoid layoffs.

- My employees could work remotely if they had a specific software or computer application, but I cannot afford to purchase. Without this software, I will need to layoff my workforce until we can go back to the office.

- I need my 8 employees to continue to work on site, but I am concerned about their potential exposure to COVID-19 and cannot afford frequent deep cleaning to help limit potential exposure. If I had funds to support the deep cleaning, it would allow my workers to continue to work and would foster a safer work environment.

- Due to the impacts of COVID-19, my employees have more down time than usual. If I were able to offer the opportunity for them to take project management training online during this down time, they will increase their skillsets, making them a valuable asset to our company and less likely a candidate for layoff.

Get Started Now!

- ✔ View the One Pager

- ✔ COVID-19 Layoff Aversion Fund Policy

- ✔ COVID-19 Layoff Aversion Fund Application (Excel)

Submit your completed application to: LaborCOVID19.layoffaversion@maryland.gov.

Labor staff will process applications within two business days of receipt. Upon approval and receipt of signed contract, payment will be expedited.

For More Information…

Contact the Division of Workforce Development and Adult Learning.